WeWork India IPO listed at Rs 650 per share on NSE- a 0.31% premium. On BSE it listed at Rs 646.50 per share: a 0.23% discount.

The highly-awaited listing of the provider of flexible workplaces occurs when overall market mood is still cautious despite volatile global cues. The IPO, which closed last week, saw a lukewarm response from the investor community, and the latest grey market sentiments indicate a flat to dull listing.

About the Company

WeWork India is the licensed subsidiary of the world’s largest coworking giant, providing flexible office spaces in India’s key metros like Bengaluru, Mumbai, Gurugram, and Hyderabad. It is an asset-light leasing company that occupies Grade A commercial real estate, fits out the same, and provides modular workspace solutions to businesses, startups, and professionals. The brand has consistently grown its presence as demand for hybrid and collaborative office models has increased in post-pandemic India.

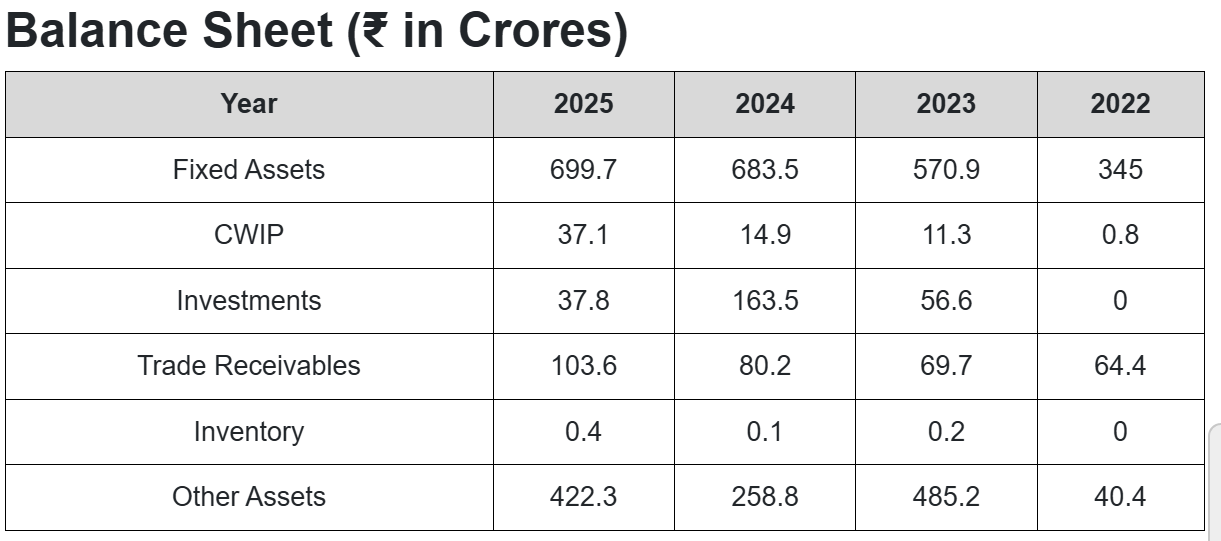

WeWork India’s balance sheet presents an intriguing tale. Over the last three years, fixed assets have nearly doubled. Although they also indicate that more funds are being invested in daily operations, trade receivables and work-in-progress figures suggest that operations are growing. Conversely, investments have decreased, indicating a shift from holding capital to using it locally. When a company is in growth mode, it is exciting to investors, but once it enters the public markets, it will need to demonstrate that it can maintain that momentum.

IPO Details

Overall subscription: 1.15×

Qualified Institutional Buyers (QIB): 1.79×

Non-Institutional Investors (NII): 0.23×

Retail Investors (RII): 0.61×

Issue type: Offer for Sale (OFS) of 4.63 crore shares

Price band: ₹615–₹648 per share

Lead manager: JM Financial

Registrar: MUFG Intime India

Mellow expectations ahead of We Work Debut

As per market observers, the grey market premium (GMP) of WeWork India has been fluctuating at zero levels, indicating that the stock will most probably come out at par with its issue price of ₹648 per share. The GMP had come in positive briefly during the days preceding the subscription window but cooled down later, indicating a more cautious mood among investors in the run-up to the listing.

The IPO is a pure Offer for Sale and hence will not introduce fresh capital into the company. It is merely an opportunity for existing shareholders the parent group and early investors to partially exit. The brand has high recall and stable revenue growth, yet investors are skeptical about the profitability path of the business and valuation, particularly in the context of the cyclical nature of commercial real estate and changing demand trends in the coworking space.

What do the experts say?

As the business moves toward its stock market launch, investors and analysts will be keenly observing a number of things — the opening price gap against GMP hopes, early trading volumes, and institutional action in the initial hours. The wider market tone and liquidity context may also have an important bearing on the way the listing proceeds.

As of now, the indicators point towards a placid, vigilant rather than bangalore-style listing. However, for a company as established as WeWork, consistent post-listing performance — with occupancy growth, operational efficiency, and cash flow uniformity being the key drivers — will dictate if it can ultimately be in command of investor faith on Dalal Street.