Ever bought a call option before a big event like the RBI policy and thought, the market will go up, and it does go up. But your premium?

It tanks.

No, your broker isn’t cheating you.

You’ve just been hit by the silent killer of option buyers — IV Crush.

First, what’s IV?

Implied Volatility (IV) is just the market’s way of pricing in uncertainty.

Before big events — think RBI policy, budget, major earnings — nobody knows what’s coming. That uncertainty jacks up IV, and as a result, option premiums get expensive.

You’re not just paying for direction. You’re paying for the possibility of chaos.

But here’s the catch: once the event is over and the dust settles, that uncertainty disappears.

And so does the inflated part of your premium.

What Does IV Crush Look Like?

Say Bank Nifty is at 50,300. You buy a 50,500 CE for ₹180 on Tuesday.

RBI announces policy on Wednesday. The market reacts mildly and moves 100 points up.

You expect your premium to shoot up.

But it drops to ₹130.

You were right on direction. But IV crashed after the event, pulling your premium down harder than the price move could push it up.

This is IV Crush. And it happens all the time — especially around scheduled news or events.

Why Should You Care?

Because it’s not enough to get the direction right.

If you're buying options in a high-IV environment and the market under-delivers, you lose — not because the price moved against you, but because the premium was already overpriced.

Option buyers often don’t realise they’re paying extra just to be in the game. And once the event’s gone? That extra gets wiped off, fast.

How to Not Get Crushed

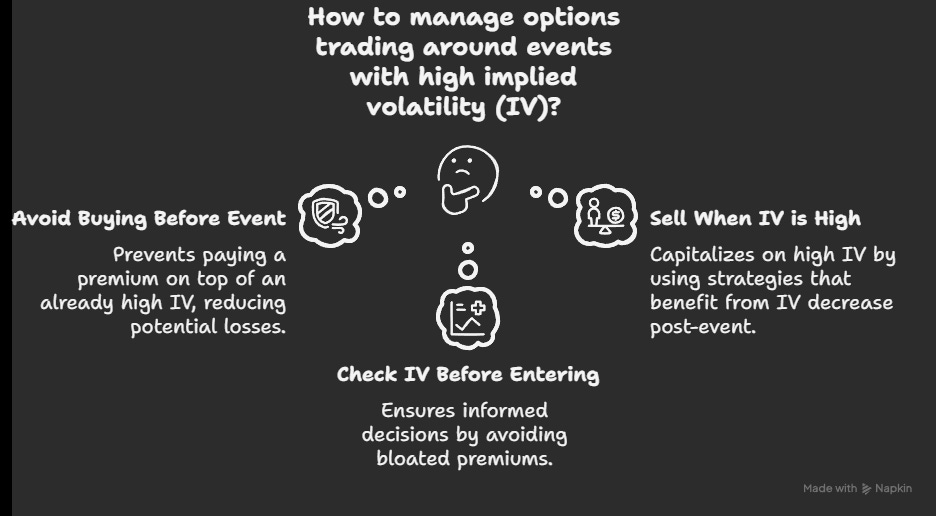

1. Avoid Buying Right Before the Event

That’s when IV is fully priced in. You’re paying a premium on top of the premium. Unless the market gives a bigger-than-expected move, you’ll bleed.

2. Consider Selling When IV is High

This is where experienced traders shine. Short straddles, strangles, or defined-risk spreads work well pre-event — because when IV falls post-announcement, sellers win by doing nothing.

3. Always Look at IV Before Entering

Don’t just check the chart. Check how pumped the option chain is. If IV is near recent highs, premiums are bloated. That’s a signal to think twice before buying.

Sahi’s Take

Every trader gets caught in an IV crush at least once. The smart ones learn from it.

Before your next event-based trade, pause and ask yourself, am I trading the actual move? Or am I paying too much for the hype?

Getting the answer right won’t just save your trade — it’ll protect your edge.