Oil prices might be set in international markets, but their impact on India is deeply local, from the cost of your commute to the health of the nation’s currency.

As one of the world’s largest oil importers, India is highly sensitive to fluctuations in crude prices. Over 85% of our oil is imported, meaning every dollar increase affects trade, inflation, and even your grocery bill.

This blog breaks down how crude oil prices ripple through India's economy, affecting everything from macroeconomic stability to market sentiment

India’s Oil Dependency: The Starting Point of Vulnerability

India’s relationship with oil is simple: we consume a lot but produce very little.

Over 85% of India’s crude oil needs are met through imports.

In FY24 alone, crude oil imports were valued at approximately $180 billion nearly one-fourth of India’s total imports.

This makes oil our single largest import and a key pressure point in our trade dynamics.

What that means in practice is this:

Every time global oil prices spike, India's economic balance starts tilting affecting our currency, current account, inflation, and fiscal calculations.

Oil isn’t just an energy source. For India, it’s a macroeconomic variable.

Key Economic Impacts of Crude Oil

Crude oil affects India at multiple economic layers. The first two and often most immediate are the current account deficit and inflation.

1. Current Account Deficit (CAD)

Oil is India’s largest import, and every price fluctuation shows up in our trade balance.

A $10 increase in Brent crude can widen the current account deficit by 0.5% of GDP.

Conversely, a $1 drop in crude prices can improve the CAD by $1.5 to $1.6 billion.

When the CAD widens, it puts pressure on the rupee, reduces foreign exchange reserves, and can dent investor confidence.

Simply put, expensive oil means more dollars flowing out than in weakening the economy’s external balance.

2. Inflation

Crude oil seeps into everything: transport, production, logistics, and daily consumption.

Rising oil prices push up fuel costs, which increase freight charges and supply chain expenses.

These get passed on to consumers as higher food and retail prices, pushing up both CPI (consumer inflation) and WPI (wholesale inflation).

Inflation, in turn, erodes purchasing power and reduces discretionary demand across sectors.

For a consumption-driven economy like India, this can quietly slow growth without warning signs.

Fiscal Deficit and Government Finances

Crude oil prices don’t just impact trade; they hit the government’s budget directly.

When oil prices rise, two things typically happen:

Subsidy Burden Increases

The government often provides subsidies on fuels like LPG, kerosene, and fertilisers, all of which are oil-linked.

When crude prices rise, the cost of maintaining these subsidies goes up, widening the fiscal deficit.

Tax Cut Pressures Mount

To contain inflation or shield consumers, the government may cut excise duties on petrol and diesel.

While politically necessary, these cuts reduce revenue and add strain to the fiscal math.

Higher oil prices create a tough trade-off for policymakers:

Support consumers and risk fiscal slippage, or protect the budget and risk inflation backlash.

Either way, the margin for maneuver shrinks, especially in pre-election years or during periods of weak growth.

Exchange Rate Impact and the Rupee

Every barrel of oil India buys is paid for in dollars. So when global crude prices rise, India’s demand for dollars surges, putting pressure on the rupee.

Here’s how it plays out:

Higher crude prices → more dollar outflow → rupee weakens

A weaker rupee makes all imports more expensive, including oil

That, in turn, raises the domestic cost of oil even more, triggering a vicious cycle of imported inflation

This currency-pressure loop is especially dangerous for India because

We rely on imported oil for energy

We also import many other commodities (metals, fertilisers, electronics)

Foreign investors become cautious if the rupee becomes too volatile

In short, crude oil is a gateway pressure point for the rupee and through the rupee, for inflation, investor confidence, and monetary policy.

Sectoral and Market Effects

Crude oil doesn’t just move currencies and budgets; it also sways the stock market, often sharply and unevenly.

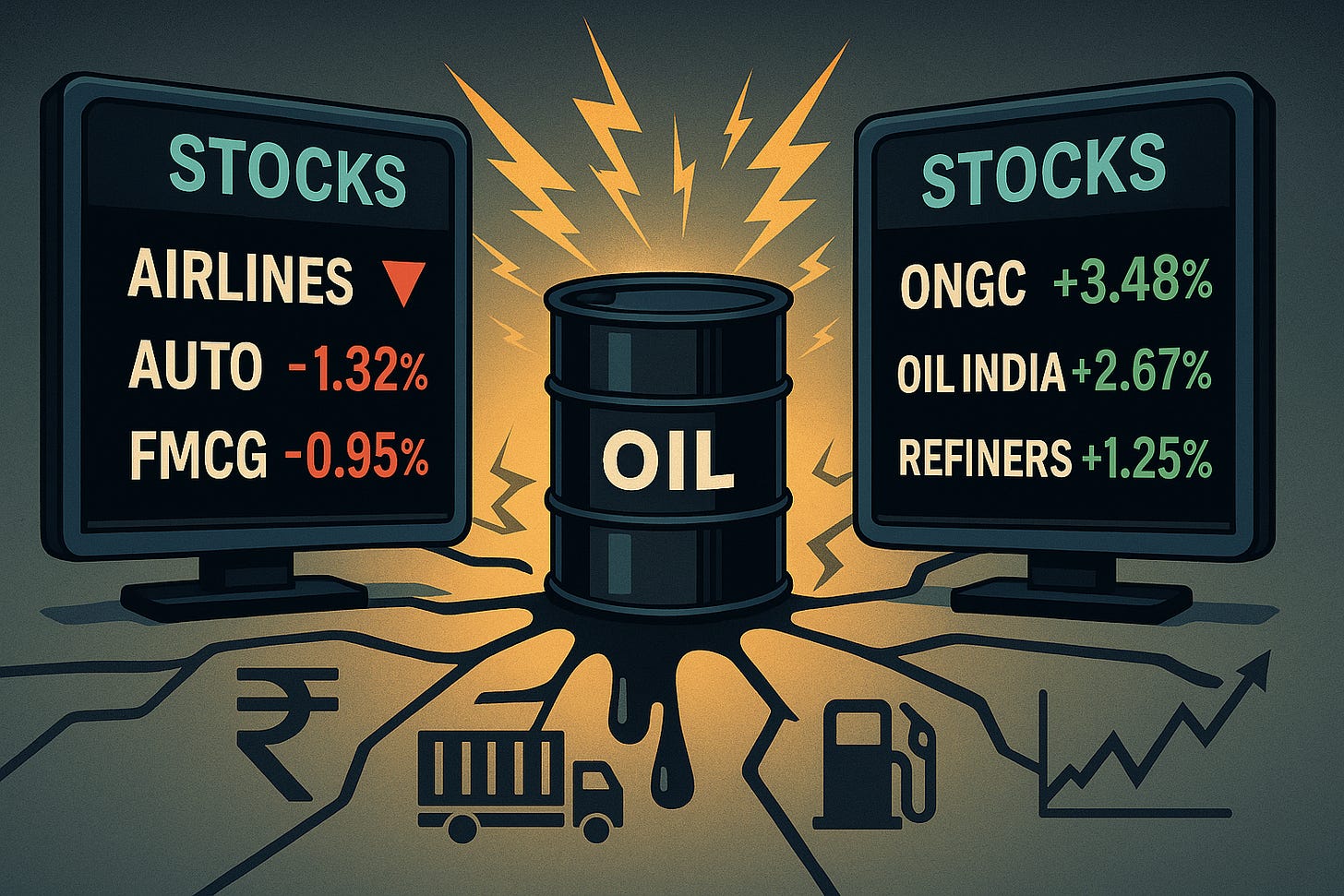

Sectors That Struggle When Oil Rises:

Aviation: Jet fuel is one of the highest costs for airlines; profits take a hit fast.

Logistics and transport: Fuel costs rise, margins shrink.

Paints, FMCG, and chemicals: Many raw materials are oil derivatives. Higher input costs = lower margins.

Auto (esp. two-wheelers): Rising petrol prices hurt demand, especially in price-sensitive segments.

Sectors That Benefit:

Oil explorers like ONGC or Oil India: Higher crude prices = higher realizations.

Some refiners and OMCs: If retail prices stay high and input costs fall, margins improve.

Energy service providers: Drilling and field services see higher demand when upstream activity rises.

On a macro level, rising crude usually leads to:

Equity market jitters, especially in energy-intensive sectors

Rotation into defensives if inflation rises

Increased volatility in bond yields, as inflation and deficit risks are repriced

For traders and investors, crude oil becomes a quiet signal for sectoral rotation often before quarterly earnings show any impact.

Crude Oil and GDP Growth

Crude oil doesn’t just impact individual sectors it weighs on the entire economy.

Here’s how:

Higher oil prices raise production costs across industries, from manufacturing to transport.

This leads to cost-push inflation, squeezing margins and reducing corporate profitability.

Consumers face higher prices for fuel, food, and daily essentials, which erodes disposable income and pulls down demand.

Over time, this slows.

Private consumption (a key driver of India’s GDP)

Corporate investment (as input costs rise and profits shrink)

Government spending capacity (due to fiscal stress)

According to studies, a sustained $10 increase in crude oil prices can reduce India’s GDP growth rate by about 0.25–0.27 percentage points.

In other words, expensive oil acts like a tax on growth, silently dragging momentum without needing a policy move.

Policy Measures and Conclusion

India doesn’t control global crude prices but it has worked to reduce its vulnerability.

Key Policy Measures:

Strategic Petroleum Reserves: To buffer short-term supply shocks.

Fuel Pricing Reforms: Dynamic pricing and deregulation help pass on price changes and reduce subsidy strain.

Energy Diversification: Accelerated push toward solar, biofuels, ethanol blending, and EV adoption.

Bilateral Agreements: Diversifying crude import partners to manage geopolitical risks.

Efficiency and Demand Management: Encouraging fuel efficiency in transport and industry.

Despite these, India’s economy will continue to be exposed to oil price swings especially during global disruptions or supply chain shocks.

Sahi’s Take

Crude oil is not just a global commodity for India; it’s a macroeconomic lever.

It affects:

What we pay at the pump

What the RBI does with rates

How the rupee moves

And how the markets react

When crude rises, the economy feels the pinch through higher deficits, inflation, and slower growth.

When it falls, it’s an unexpected relief, giving India more room to breathe, spend, and grow.

In the long run, building energy security, reducing dependence, and embracing cleaner, local energy sources will be India’s real insulation.

Until then, oil will continue to shape the Indian economic story often quietly, but always decisively.