In early 2020, as the world slowly woke up to the economic threat of COVID-19, most investors were still buying the dip.

Bill Ackman wasn’t.

While markets were still shrugging off the virus as a temporary blip, Ackman, founder of Pershing Square Capital, saw something bigger coming: a full-blown credit event. But instead of selling his entire portfolio, he made a $27 million bet that would explode in value within a month.

When panic peaked, that hedge was worth $2.6 billion.

The trade didn’t just save his portfolio; it made him a legend.

A World on Edge

January 2020 started like any other. Markets were cruising near all-time highs. The S&P 500 had just wrapped up a stellar 2019. Optimism was everywhere.

But beneath the surface, something was building.

The novel coronavirus had begun spreading beyond China, and by February, cases were appearing in Europe and the U.S. Lockdowns were looming. Supply chains were breaking. Yet most investors were still in “wait and watch” mode.

Not Bill Ackman.

His fund, Pershing Square Capital, was heavily exposed to sectors most at risk: hospitality, restaurants, and retail. These weren’t just any holdings; they were long-term bets he wasn’t ready to exit.

So instead of selling out, Ackman went hunting for a hedge not just against falling stock prices but against what he saw as a coming collapse in corporate credit.

The Trade: Hedging Without Selling

Ackman’s genius wasn’t just that he saw the crisis coming; it was in how he positioned for it.

Instead of dumping stocks from his long portfolio names like Hilton, Starbucks, and Lowe’s, he kept them. Selling would’ve triggered tax liabilities and gone against his conviction in their long-term value.

So he took a different route: hedging through the credit markets.

Ackman spent $27 million buying credit default swaps (CDS), essentially insurance contracts that pay out if companies default on their debt or if credit conditions worsen.

Here’s how it worked:

He targeted investment-grade and high-yield corporate bonds, betting that as panic set in, their spreads (risk premiums) would spike.

If companies got riskier, the cost of insuring their debt would surge, making his CDS positions more valuable.

The more fear in the system, the more his hedge would pay.

He wasn’t shorting stocks. He wasn’t betting on bankruptcies.

He was betting that the credit market would blink before the equity market fully caught on.

“It was like buying fire insurance on a building that was already starting to smoke.”

The Payoff: When Panic Peaked

By March 2020, fear had gone global. Markets were crashing, companies were drawing down credit lines, and investors were rushing to safety. As predicted, corporate bond spreads blew out, and the CDS market went into overdrive.

Ackman’s $27 million hedge?

It ballooned to $2.6 billion in just under a month.

The timing was almost surgical:

He began building the position in February.

Held firm through early March.

Exited the trade on March 23, 2020, the same day the Fed announced unlimited QE and markets bottomed.

He sold at the peak of fear, just as credit spreads were at their widest. That exit not only locked in a near 100x return, it also gave him dry powder for what came next.

“It was the single best trade of my career.”

But he wasn’t done yet; he took the proceeds and went on the offensive.

The Controversy: Panic or Preparation?

On March 18, 2020, five days before markets bottomed, Ackman went live on CNBC in a now-famous interview.

He warned that “hell is coming” if the U.S. didn’t shut down for 30 days to contain the virus. He urged the government to act fast, calling COVID-19 “a tsunami coming for the American economy.”

The markets dropped sharply during and after the segment.

Critics accused him of fearmongering, especially when news broke just days later that he had closed his CDS position at peak value and was reinvesting in the same companies he warned could collapse.

To some, it looked like a trader talking down the market and then buying the dip.

To others, it was just a hedge fund manager doing what he said he would do all along hedge first, then buy quality at fire-sale prices.

Ackman defended the timing:

“We were speaking out to save lives and the economy. The fact that we profited from a hedge doesn’t change the message.”

Love him or hate him the move was legal, well-timed, and wildly profitable.

Why It Worked: Strategy > Prediction

Ackman didn’t make billions by predicting a pandemic.

He made it by preparing for what would happen if one spiraled out of control.

Here’s why the trade worked so well:

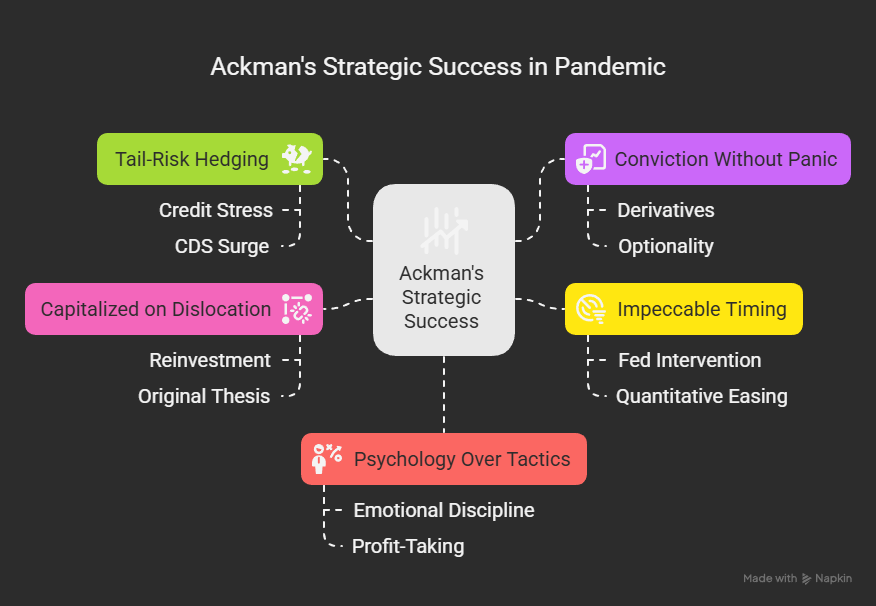

Tail-Risk Hedging Done Right

Instead of hedging through puts or shorting the index, he bet on credit stress, a more direct reflection of economic damage. When companies panicked, tapped credit lines, or saw risk premiums spike, CDS surged.Conviction Without Panic

He didn’t panic-sell his longs. He protected the portfolio through derivatives, buying himself time and optionality.Impeccable Timing

He exited the hedge right as the Fed stepped in with unlimited quantitative easing. It wasn’t luck he saw that peak panic had arrived.Capitalized on Dislocation

Instead of retreating, he rotated into opportunity. The reinvestment wasn’t an afterthought; it was part of the original thesis.Psychology Over Tactics

Ackman had the emotional discipline to act before the market caught on and to take profits before greed took over.

“You don’t make 100x trades often but when the world misprices risk, you don’t need to be early. You just need to be prepared.”

Legacy of the Trade

Ackman’s 2020 hedge wasn’t just a big win; it was a case study in how hedging, timing, and conviction can come together to protect and grow capital in the face of chaos.

His $27 million bet delivered $2.6 billion, a nearly 100x return, in just a few weeks.

Pershing Square ended the year with a 70% gain, one of the strongest performances in the fund’s history.

And the trade now sits comfortably alongside the greats Michael Burry’s 2008 short, George Soros vs. the Bank of England, and John Paulson’s housing collapse play.

But more than the numbers, Ackman’s move showed that

You don’t need to predict the exact crisis.

You just need to see the fragility, price the risk, and have the courage to act early.

And when the world is frozen in fear, liquidity + clarity = edge.

What Traders and Investors Can Take Away

Hedging isn’t about being bearish; it’s about being ready.

The best trades don’t always chase upside; sometimes, they insure against downside and buy time.

And in a market meltdown, capital + conviction = opportunity.

Ackman didn’t just survive 2020.

He flipped the panic into profit and the hedge into a legend.